Hi, everyone

China was on track to surpass the United States and take over as the greatest economy in the world just a few years ago. Many people believed that this would occur as soon as 2024 in 2014. Few could have predicted the implications that the economic reform in the late 1970s would have on the developing nation as China went from a third-world to a worldwide superpower in a span of a few decades. This economic miracle is seen by many as a success story. Soon, more and more Chinese businesses started to appear on lists of the biggest corporations in the world. The nation served as one of the most significant trading partners on a worldwide scale, accelerating globalization on a never-before-seen scale. Influence followed the power. Fast forward a few years and China is faced with a wide range of political and economic concerns, including a disastrous zero COVID policy, a housing debt crisis, problems with the country’s external infrastructure, internal debt problems, a minor youth uprising, and a slowing economy. The effects of these problems pose a threat to the nation’s very political systems.

So how did China get here? And what are the consequences for the country and the world as a whole?

Let’s start with comprehending the topic that has received the greatest attention, the real estate bubble. Both the Chinese economy and the property market saw their biggest expansions in 1979. with financial reform. China began to open up to the rest of the world from this point. People are moving in large numbers from rural areas to the major urban centers as they try to enhance their quality of life. As a result, China’s population shifted from being primarily rural to living in major urban centers, making up two thirds of the country’s population, in just four decades. In addition to relocations, a cultural factor also helped increase housing sales. Real estate ownership was regarded as both a requirement for getting married and a source of stability for a family’s finances.

This caused entire families and their friends to start saving money in order to help their relatives buy a house. Why, you might wonder? Because apartment prices have grown so out of hand, China has some of the worst housing affordability in the world, according to the Financial Times. It will take the typical income 50 years to buy an apartment after living expenditures are taken into account. The Chinese real estate market differs significantly from the Western one in that money is pooled collectively. Major supply problems are caused by insufficient inventories, delayed development, and quick growth. Consequently, costs increased and local governments had a problem providing affordable homes. In addition to lowering the requirements for personal credit lending, the solution involved providing loans to businesses engaged in real estate development. for these reasons. An enormous amount of economic growth was powered by the Chinese real estate industry, which took off like a rocket. Some businesses, such as the notorious Evergrande, seized the opportunity and rapidly grew, helped in large part by the accessibility of low-cost borrowing. Evergrande grew to be so big that they even invested some of the money on a theme park and a soccer team. The theme park has been closed down. Soon you’ll understand why. It’s a horrible loss of time, money, and resources overall.

Many of these real estate institutions grew swiftly to be the biggest in the nation, and many of them expanded ventures into foreign markets. Sales of commercial real estate topped $2.7 trillion in 2020. About 70% of the total wealth in China is currently held in the real estate sector by the ordinary populace.

Let me repeat that 70% of the total wealth in China is currently held in the real estate sector by the ordinary populace.

Although there was still a shortage of housing, partly as a result of speculation, it was usual practice to invest in a second or third home because doing so was regarded as a prudent and reliable use of money. A clever approach was developed by developers in response to the seemingly endless requirement to support growth. They were supported by two main pillars. They initially started using international debt to fund their operations. Global demand for Chinese debt and equity was rising as a result of the country’s rapid economic expansion and its alluring yields. Second, developers produced presale alternatives for customers, which swiftly spread throughout the nation. In it, purchasers of real estate would pay builders for a house that has not yet been constructed. All they had was a guarantee that it would be there once it was finished.

Although it made sense for both parties, things quickly got out of hand. Property developers began to take advantage of the system because of lax limits about how much money they could keep. They were able to launch new projects while still working on the previous ones because of pre-sales. They would use some of the proceeds from the new pre-sales, while the remainder went to new projects and so on, to finance the actual building once the new projects had produced new pre-sales. They essentially designed a Ponzi scheme that depended entirely on the steady and unabated rise of the property market.

The plan, however, began to unravel when the population growth in large cities decreased from 4.1% in 1996 to 2.1% in 2020. Pre-sales began to slacken, and developers began to rely more and more on banks and foreign debt to fund expansion. When the loan payment was too high to be covered by operational profits, they had to take on more debt to fulfill their commitments. For a while, everything went on, but soon the Chinese government joined the plan.

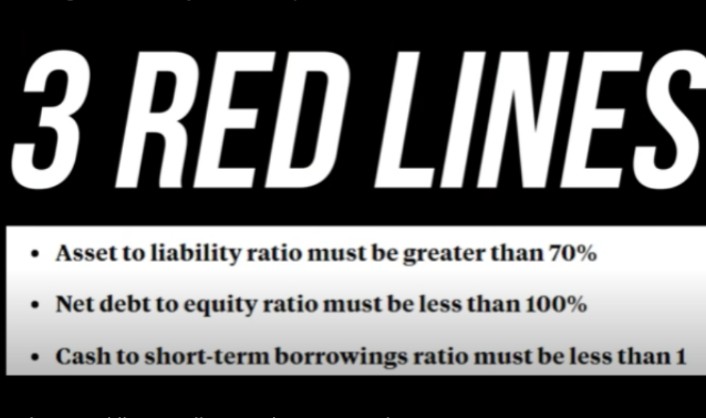

The three red lines policy, each representing a debt percentage that the corporation has had to abide by, was put into effect by the Chinese government in August of 2020. If not, they would have had a lot of trouble taking on new liabilities. Developers with extremely high debt levels, like Evergrande, crossed all three thresholds, which prevented them from increasing their liabilities further. Evergrande quickly had liquidity issues because they had already financed past liabilities with debt. The wealth managers who had a direct investment in the business were not firstly paid back. And as a result, a major uprising of wealth managers and investors took place, with many of them protesting at their headquarters.

Soon after, Evergrande’s dollar bond payments began to decline. And the Western world purchased these bonds. They weren’t the only real estate company having problems, though. In November 2021, real estate developer Caesar failed to make a $400 million bond payment. Additionally, the Shemaiah group fell behind on a loan of $101 million in January 2022, and most recently, the Yuzhou group asked to postpone the payment of 582 million in offshore bonds. As a result, both domestically and internationally, there was a significant decline in trust in the Chinese housing and bond markets. This resulted in mortgage strikes by eminent purchasers who are paying their bills each month but not seeing any development on their purchased property. More than 320 homeowner groups are thought to have stopped making mortgage loan payments at the time of this writing.

These debts are worth between $150 billion and $300 billion, according to estimates. Since then, the Chinese government has loosened the regulations a little. Additionally, in an effort to stimulate the lending and housing markets, the Chinese central bank has lowered interest rates. We’ll have to wait and watch how this plays out. It’s unclear whether the situation will calm down or if additional real estate developers would declare bankruptcy, sparking turmoil. In addition to all of this, the real estate sector accounts for about 30% of China’s annual GDP. There will be repercussions if the real estate sectors collapse. Banks, regional administrations, and China’s stability are all at stake.

Even if everything said above can seem awful, new debt problems are starting to materialize. Numerous costly infrastructure projects that are heavily indebted have proven unsuccessful. The superspeed railroad is a notable example. As a means of injecting cash into the economy and generating jobs, the infrastructure initiative got underway following the 2008 financial crisis. It was an ideal example of a traditional fiscal policy improvement. Millions of people were given jobs as a result of the project, which also single-handedly saved some industries from default, like steel and concrete. This was a major factor in China avoiding the unrest that the majority of other nations experienced during the 2008 financial crisis. Although it prevented a recession, issues emerged as soon as construction was complete. The demand wasn’t always there because the train only went to secondary locations rather than major ones. Additionally, since most people couldn’t afford the ticket rates, a lack of money may not have been a problem. However, this project was financed by enormous amounts of debt taken out by big banks, regional authorities, and certain bonds that were sold to the public.

From 2015. The project’s operating income has been more than offset to this point just by the interest on these payments. That’s correct, interest on the debt has exceeded the company’s earnings. Their total liabilities as of 2021 were 5.9 trillion yuan, or $900 billion. 5% of the Chinese GDP, in other words. Bonds that were sold to state banks make up the majority of these liabilities. The Zurich COVID lockdowns have resulted in even less use of the rail network. The Chinese government announced an economic stimulus plan in response to help the COVID-affected economy. This includes enabling the China Railway to expand on an existing unsuccessful business by issuing further railway construction bonds totaling 300 billion yuan. It appears that China is prioritizing aesthetics over efficiency and profitability, which can lead to serious problems if not corrected. due to excessive debt expansion, profit-driven decisions, and inadequate planning. China is home to several ghost cities. These are locations with significant infrastructure and property that essentially go uninhabited.

In addition to its internal financial problems, China is having difficulties with its infrastructure development abroad. The Belt and Road Initiative is in danger of becoming one of the most unsuccessful global initiatives ever. The project represents a significant investment in more than 100 nations. It is China’s ambitious effort to forge relationships around the world and increase its influence there. China should expand its export and import markets. Investments in dangerous nations are, nevertheless, inherently risky. These investments might also end up being extremely unsuccessful endeavors if the calculations are not done properly. China has had to restructure more than $52 billion in debt alone in 2020 and 2021. Additionally, many of the nations China trades with are reluctant or unable to make payments. Due to the Belton Road programme, China has surpassed both the World Bank and the IMF as the largest provider of development loans globally. The state government is likely to continue funding this initiative because it is political in character and hence unlikely to be profitable. China may be able to exert unimaginable global influence, but doing so carries the potential of disastrous consequences for its financial stability as well as the political stability of other nations as a result of its meddling in their internal affairs.

As if the country’s internal and foreign debt problems weren’t already enough, the Chinese government still advocates for a zero COVID policy. On paper, there was a strategy to get rid of the illness. For a while, it worked to project the image of the government as competent and capable of handling any situation. According to official statistics, the number of people who have died from the virus in China as of today is just over 5000, compared to more than 1 million in the US. Regardless of how manufactured these performances may be. The authorities may use this low figure as justification for lockdowns while herd immunity prevents the rest of the world from moving on. China, however, is unable to do so since they lack innate immunity.

After they made the announcement about the zero COVID policy and how it might last for more than five years. Quickly, the general public’s impression of the lockdown was altered. In a dystopian nightmare situation, people are currently protesting lockdowns.

Even if the state decided to change its policy now, it would be a total catastrophe on a political and humanitarian level. Fudan University in Shanghai estimates that the death toll may exceed 1 million. Additionally, it would be a failure on the part of the state leadership, which is totally unacceptable as the government gets ready for the 20th Party Congress, when the current president, Xi Jinping, will continue serving as the party’s leader for a third straight term. Since saving face is a big part of Chinese culture, the government must project their superiority, no matter how staged it may seem to their western counterparts. As a result, a slowdown in the economy and rising public discontent seem to be the only viable path for the state authorities moving forward if they backtrack.

What does this mean for the economy?

Well, among educated young people, 1/5 of them are currently unemployed, which is a significant reduction in internal demand and a sign of rising employment, particularly among the young. The zero COVID policy has been one of the primary factors contributing to the global recession on the external front, and there has been a decline in trust among international companies that depend on China for imports and exports. Apple is the most extreme example, as it is shifting some of the production of the iPhone 14 to India.

The economic and political issues are not the only problems for the state government either. increasing unemployment among the young and educated is quickly on the rise, climbing to a record 20% in July of this year. This is mainly due to the slowing down of the economy and the shrinking opportunities that come with it.

A well-known online trend in 2021 went by the name of “TANG PING” or “LIE FLAT.” In essence, it was a movement of young people who opted to slow down and quit playing the rat race and climbing the corporate ladder online. But as of 2022, this has changed into a brand-new, more radical movement called “BAI LAN” or “LET IT ROT.” These children are just doing the barest minimum to get by because they have entirely decided to give up on the system. The older Chinese who have never witnessed something like this in their lifetimes are in full shock. The young people in the byline region think that working hard and exerting extra effort will not be rewarded.

The Chinese authorities took notice of this quickly. President Xi Jinping stated that “China’s prospects rest in youth” in a speech to the entire country in May 2022, emphasizing the value of youth and their contributions to the nation as a whole. They have long placed a high premium on reducing inequality and expanding possibilities. However, the steps implemented, such as restraining big tech and eliminating private school tutoring, have not significantly improved the issue.

So that’s a quick rundown of recent events in China. There was a lot left unsaid; we didn’t even discuss the 400,000 people in rural areas who can’t access their life savings. But you get the point. Other YouTube clickbait headlines are also real. Will China collapse? The answer, however, is more intricate than that. It appears that China is prioritizing its political objectives over humanitarian and economic needs. China is in an awkward situation as a result of the ruling class’s obstinacy. Major fractures are suddenly developing throughout an apparently unstoppable nation, cracks that require more than a band-aid fix. A loss of public confidence in the state government poses the biggest threat to all of the issues discussed, and regaining that confidence will be challenging. In the coming years, political unrest and a slow-motion recession may be the most likely outcomes. But in the end, the study is too complex for anyone to provide a definitive response. However, more needs to be done to prevent matters from getting worse and to restore the public’s faith in the government.

One thing is certain: China faces significant risk in 2023. And how the Chinese government responds will determine whether things significantly worsen or not.

How about the rest of the world, though?

As for the rest of the globe, these issues with China will undoubtedly have a significant impact, particularly on those who rely directly on China’s import-export market. Given the decline in Chinese supply, we may anticipate the inflationary tendency to persist. in behalf of the USA. Because of this, 20% of all imports may be impacted. In addition, as more nations turn to domestic production and lose access to cheap labor, prices will rise as de-globalization becomes a more prominent trend. Due to the fact that nearly 65% of Australia’s exports went to China, some economies, like Australia, could be in serious trouble. That exposure risk is really high. And as the majority of Australians are aware, there aren’t many other trading partners who could make up for a loss like that. Major setbacks will also be seen in some industries. One example is the EV battery market, where 76% of the world’s lithium-ion batteries were produced in China. Despite ongoing attempts by the governments of the US and Europe to expand their output, the stark reality is that China is a significant economic partner that cannot be quickly replaced.

Last but not least, it’s crucial to note the investment exposure that many nations have to Chinese debt and stocks. This includes a large number of US and European investment businesses in addition to all the funds that have lost money as a result of the multiple delistings of Chinese stocks over the past several months. In addition, the downturn in China may make it harder for the US to issue debt. Considering that China is the second-largest holder of US Treasury securities.

Positively, there is a decrease in fuel demand. China imports 80% of what it requires, and this will put some downward pressure on pricing, helping to ease the current energy crisis, as well as some downward pressure on input costs for virtually every commodity produced.

In general, the interdependence of the world’s markets has long been the growth engine, as well as the century’s economic prosperity’s Biggest weakness. A worldwide slowdown results from a recession in one of the world’s main economies. Observing the changes that take place will be quite intriguing. Will this affect future changes in international trade? Will countries eventually start to turn inside or will globalization still remain a trend? Will production become more regionally focused? Only time will tell if the outlook for China or the world economy as a whole will change. What do you people think, then?